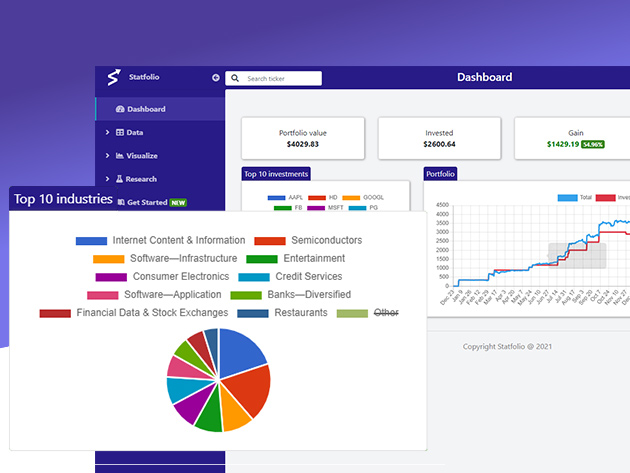

Statfolio is a portfolio tracker for anyone who owns financial investments and wants to better understand how they are performing. It can be used by retail investors, accountants, professional investors, and portfolio managers. It's focused on analytics and visualization. It can answer some important questions like "How did my investments perform over the past year?", "Is my portfolio diversified enough?", "What is happening with some individual sectors/industries of my investments right now?" and more.

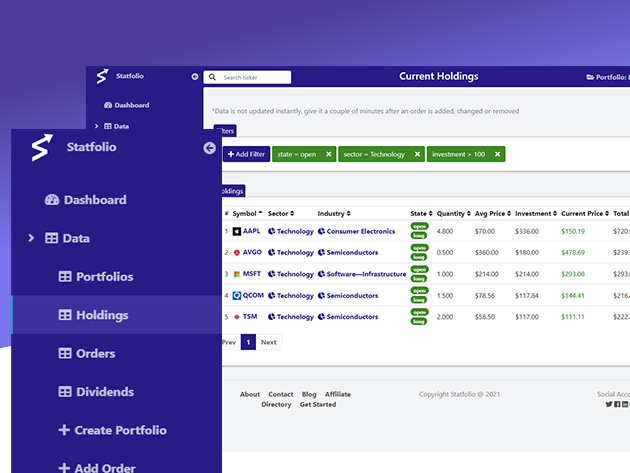

Statfolio is structured into 3 sections. The raw and aggregated data shows you the portfolio ad orders you've created as well as the holdings Statfolio automatically aggregates and the dividends you received under the portfolio. The visualize section lets you see the metrics at portfolio, sector, industry, or holding level. In the research part, you can understand the current state of the market, discover potential new investment opportunities, and study company data. Leverage these powerful analytics and take control of your investments!

Statfolio is a nominee for "The Best Portfolio Tracker" in the Benzinga Global Fintech Awards

Automatic Aggregation

-

Current holdings. See how each holding is performing; both long & short positions supported

-

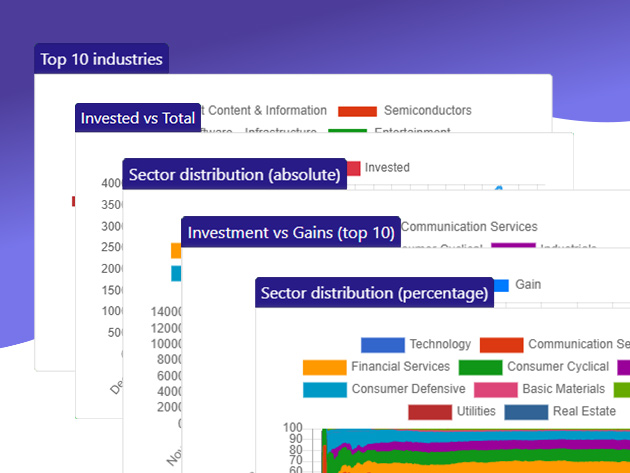

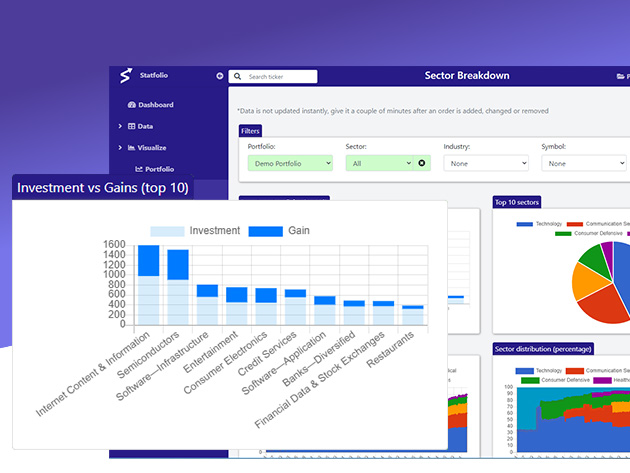

Breakdown at sector/industry/holding/order level. Understand how each component contributes to the overall performance

-

Time-based charts. Understand the current situation & how you performed historically

Powerful Analytics

- Identify underperforming holdings

- Spot sector rotations early on

- Understand your diversification

- Daily updates for price & dividends

Insightful Segmentations

-

Portfolio level. See all the sectors/industries/holdings in your portfolio & how much each contributes

-

Sector level. Understand the industries in a specific sector

-

Industry level. Understand the holdings in a specific industry

-

Holding level. Analyze a single holding & see how it evolved over time and how much dividends you gained from it

Statfolio Basic Plan

- For aspiring investors that want to understand and improve their investments

- 3 portfolios

- 500 orders

- 50 holdings

- Medium Priority Support